Displaying items by tag: Current

SAVED!

Allen Park was purchased by Salt Lake City and opened to the public on October 4, 2020.

“Allen Park is a rare opportunity to preserve almost seven acres of unique ecosystem in a historic area that would otherwise be developed by private entities,” Mayor Mendenhall said. “We have heard the request from many members of our community to use parks impact fees to purchase this land, and are grateful for an opportunity to be able to do so.”

“This is an iconic parcel in a City that needs more open space,” said Chris Wharton, City Council Chair. “We hope we will have partners to help make it an important public park soon.”

https://www.slc.gov/parks/allenpark/

https://www.sltrib.com/news/politics/2020/03/31/salt-lake-city-under/

The Alrasool Islamic Center of Utah, alongside community partners CRSA Architecture and Preservation Utah, are pleased to announce that Alrasool has been awarded a prestigious 2023 National Fund for Sacred Places restoration grant. This matching grant assists Alrasool in engaging the community in restoring its 1894 mosque and its 1910 community and educational center located at 1247 West 4800 South, Taylorsville (84123). These conjoined buildings were originally constructed by pioneer-era craftsmen to serve members of the Church of Jesus Christ of Latter-day Saints. This complex is one of two sites in Taylorsville listed on the National Register of Historic Places and the first Taylorsville building ever to be listed on the Register. Receiving this National Fund for Sacred Places Grant is a tremendous honor for Alrasool as the congregation was one of just sixteen recipients in a pool of nearly four hundred applicants. This grant marks the first time that the National Fund for Sacred Places has selected a Muslim congregation and the first time that the Fund has given to a Utah-based congregation.

The Alrasool Islamic Center building is truly a Utah architectural treasure. The chapel is an assembly-hall-type building constructed in 1894 by Utah handcart pioneer Archibald Frame. The adjoining cultural center was constructed fifteen years later by Archibald Frame Jr., the son of the original builder. The Alrasool Center is one of the few surviving buildings left in Utah that document the evolution of the Mormon chapel. Rather than adopt Catholic, Protestant, or other mainstream Christian architecture, the Mormon Church's nineteenth-century practitioners established new architectural typology to accommodate their faith practice. These buildings, which included temples, tabernacles, and chapels, were instrumental in helping to settle America's Intermountain West as they provided both focal points and gathering spaces for the hundreds of new communities established by Mormon pioneers. Of all the buildings constructed by nineteenth-century Mormons, chapels most directly addressed each settlement community's daily needs. These chapels served as religious centers and the West's first Anglo-American educational, political, and social centers.

Beyond its architectural significance, the Alrasool buildings’ importance stems from their years of use as a center of faith and community gathering. For well over a century, Alrasool's building have sheltered various communities, providing them with a place to worship and develop bonds anchored in cultural exchange. As previously noted, immigrant Mormon pioneers first built this sanctuary in 1894 to operate as a religious, cultural, educational, and recreational hub. Prior to its purchase by Alrasool, this building housed the Mount Calvary Assembly of God. Today, the building houses a mosque, community center, and event space for a multinational Shi’a Muslim congregation drawing from Utah, Nevada, Idaho, and Wyoming. Alrasool's congregation was established in 1988 by a handful of young Shi'a men who immigrated to the United States after fleeing the 1979 establishment of the Iranian Republic and the subsequent 1980-1988 Iraq-Iran War. Since 1988, Alrasool has welcomed waves of immigrants from Iraq, Iran, Afghanistan, and other parts of the Middle East, many of them refugees of war. Alrasool's present congregants are mindful that their building has long represented America's promise of religious freedom, equality, and the opportunity for a better life.

While this historic building requires extensive work, Alrasool's congregation is highly motivated to restore this facility and ensure that it serves as a religious and cultural gathering place well into the future. The importance of this building to members of the Mormon faith and to the state’s growing Muslim population makes this restoration attractive as an opportunity to bring diverse people together to celebrate the shared history and collaboratively work towards rehabilitating a vital community landmark. Alrasool asks Utahns to help restore their landmark building. Every dollar raised up to $100,000 will be matched dollar for dollar by the National Fund for Sacred Places. A dollar will match every two dollars raised above $100,000 from the National Fund. Donations are tax-deductible, and every dollar donated to this effort will directly fund the restoration of Alrasool’s historic buildings.

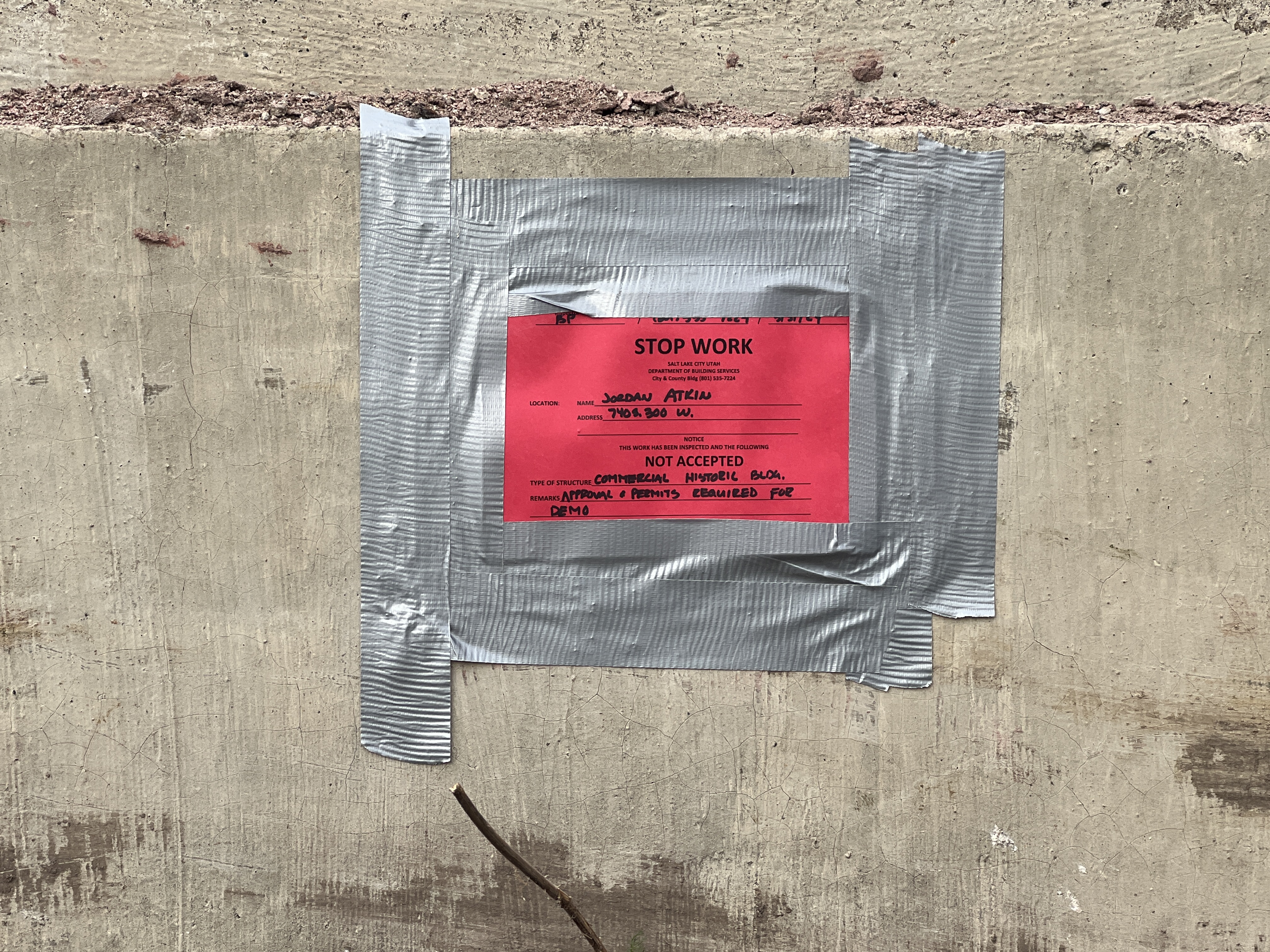

The saga of the Fifth Ward Meetinghouse in Salt Lake City took a tragic turn on Easter Sunday when a wrecking crew illegally demolished part of the historic building without a permit. The demolition, initiated by 300 West Holdings, LLC, owned by Jordan Atkin, sparked immediate concern and outrage within the community.

The illegal activity was abruptly halted by city planners who intervened and issued a stop order, citing the lack of proper permits for the demolition. Despite attempts by the demolition crew to claim they had permits, the city swiftly shut down the operation. Police were called to the scene as the crew hastily vacated the premises, leaving behind a scene of destruction.

Jordan Atkin, the registered manager of 300 West Holdings, LLC, expressed shock and dismay over the incident, disavowing any knowledge or involvement in the unauthorized demolition. Questions remain about how such a brazen act could occur, particularly on a significant holiday and without proper authorization.

Before the illegal demolition, the building had already shown signs of neglect, with boarded-up windows and broken infrastructure. County records indicate that property ownership had changed over the years, with the LDS Church possibly relinquishing ownership in the 1970s.

The unauthorized demolition of this historic landmark has ignited concerns within the community about the preservation of Salt Lake City's architectural heritage, especially in the face of rapid development and change. It serves as a stark reminder of the fragility of the city's history and the need for vigilant preservation efforts.

As the city addresses this egregious violation, efforts will be made to ensure that no further damage is done to the site without proper permits and inspections. The city will engage with the property owner to seek a resolution that aligns with historic preservation regulations, aiming to safeguard the remaining integrity of the Fifth Ward Meetinghouse for future generations.

The Fifth Ward Meetinghouse in Salt Lake City, a cornerstone of the local community, stood as a testament to over a century of history and evolution. Built in 1910, this red-brick structure served multiple purposes throughout its storied existence, reflecting the changing needs and demographics of the surrounding area.

Originally constructed as an LDS chapel, the building underwent numerous transformations over the years, adapting to accommodate various uses. At different points, it served as a photo studio, music venue, office space, and even housed escort services and goth/industrial nightclubs. In 2004, it found new life as a Tibetan Buddhist temple, known as Urgyen Samten Ling Gonpa, following extensive restoration efforts by dedicated volunteers.

Despite its rich history and architectural significance, the building faced neglect in its later years, with boarded-up windows and signs of disrepair evident to passersby. County records suggest that property ownership changed over time, with the LDS Church likely relinquishing control in the 1970s.

The recent unauthorized demolition of part of the historic assembly hall has sparked outrage and concern among residents, highlighting the precarious balance between development and preservation in Salt Lake City. It serves as a poignant reminder of the city's rapidly changing landscape and the need to protect its architectural heritage for future generations.

As the city grapples with this shocking breach of historic preservation regulations, efforts will be made to assess the extent of the damage and explore avenues for remediation. Community leaders and Preservation Utah alike are committed to ensuring that the remaining structure of the Fifth Ward Meetinghouse is safeguarded and that proper measures are taken to prevent further unauthorized alterations.

670 S 1100 E, Salt Lake City

Standing on the southeast corner of the Judge Memorial School block, with a commanding view of Salt Lake City below it, Our Lady of Lourdes catholic church has served the city and the catholic community continuously for the past 110 years.

As the catholic diocese is planning the relocation of Judge Memorial High School, and the sale of the property on which it sits, the historic church is being threatened with demolition. Please help us save this sacred building and important landmark of Salt Lake City history.

At the time of the Church’s construction, the land now occupied by Judge Memorial Catholic High School was the site of Judge Memorial Miners’ Home and Hospital (Judge Mercy Hospital). Mrs. Mary Judge, widow of miner John Judge, made a sizable donation to the Diocese in 1900 for the construction of this institution which opened in 1910 to provide care for infirm and retired miners, and miners who needed medical treatment often associated with black lung disease. The hospital was underutilized and closed in 1915, but in 1918 Bishop Scanlon of the Catholic Diocese turned operation of the hospital over to the Red Cross who used it to serve influenza (Spanish Flu Pandemic) patients from throughout the valley. In 1922 the hospital became Judge Memorial Catholic School.

Over the next 100 years, the small church next door, that is, Our Lady of Lourdes Church, welcomed, promoted and supported Catholic education Kindergarten through Grade 12. Ultimately, in the mid 20th century, the parish built Our Lady of Lourdes Catholic Elementary School staffed by Sisters of the Holy Cross next to the Church. Judge Memorial became a high school grades 9 through 12.

Lourdes Church has been and continues to be the spiritual home of a dynamic, welcoming faith community. In addition to celebration of daily Mass, 5 Masses are celebrated on weekends: 3 in English, 1 Korean and 1 Filipino/1 Spanish on a rotating basis. Several movies were filmed in the Church including Stephen King’s The Stand. During the World War, the parish bought war bonds with building funds in anticipation of their post war 1951 remodel.

Presently, the Diocese of Salt Lake City is exploring the possibility of selling the property on which Judge Memorial and Our Lady of Lourdes Church are located. The parishioners of Our Lady of Lourdes Church, many neighbors, community partners and alumni of Judge Memorial would like to keep their historic church. The Church is home to a vibrant, ethnically diverse and charitable community, financially solvent and in great condition. It is important to note that despite its rich history, unique architecture and listing on the National Register of Historic Places, the church itself is under no historical protections.

If you would like to join us in our mission to keep Our Lady of Lourdes Church in our community please do the following:

- Please send your kind thoughts and hopes of preservation to: Most Reverend Oscar A. Solis, Bishop of the Diocese of Salt Lake City, Diocesan Pastoral Center, 27 C Street, Salt Lake City, UT 84103.

- We also encourage you to sign our Google Form to indicate your support for Our Lady of Lourdes building. We will use this to gather and forward your messages of support to key decision makers.

SL Tribune Article: Worshippers hope — and pray — to save SLC church next to Judge Memorial HS from wrecking ball

KSL Article: Parishioners pushing to save 110-year-old Utah church from possible sale

Their Website

Preservation Utah Position Statement on the Provo Temple

Provo’s Modernist Temple has served as a unique spiritual beacon for the past five decades and has been revered by people throughout Utah Valley and beyond. Preservation Utah asks church leadership to save the Provo Temple and, by so doing, show as much consideration for those who hold the Provo Temple dear as the church has shown those who love and revere the other temples that have been so carefully preserved and updated over the past decade.

More Information

Make a Public Comment

The Church of Jesus Christ of Latter-day Saints welcomes comments. Please email Brother Juan Becerra at to share your thoughts on why this temple should be preserved.

Facebook Page

Articles

- David Amott / Salt Lake Tribune

- Rob McFarland / Daily Herald

- Tom Fairholm / Personal Blog

- Tracey Smith / Opinion Piece

Photography Contest

Video Lectures

- Why does the Provo Temple Matter? - by Preservation Utah

Salt Lake City Public Safety Building (Historic Northwest Pipeline Company Headquarters), 1958

315 East 200 South, Salt Lake City

Updated 2/17/2022 at 9 am

Thank you! The Utah State Historic Tax Credit remains safe. H.B. 262 didn't make it past its committee hearing. There was support online and within the committee itself for the tax credit. We will continue to keep our eyes on any threats to the bill and keep you informed.

A bill was launched in the Utah State House of Representatives (H.B. 262 - Lines 77 and 1167) which if passed would have:

-

- Reduced the Utah preservation residential tax credit from 20% of qualified expenses to 10% of qualified expenses – lines 1166-1167. If someone spends $10K on a project they would get a $1,000 state income tax credit instead of $2,000.

- Eliminated the credit for corporate income tax (line 77). This would make it harder for corporations to utilize the credit when rehabilitating historic spaces for residential use or to invest in these projects.

In aggregate, the inclusion of the preservation tax credit in this bill threatened the preservation movement in Utah. Not only would this bill, if passed, make residential historic preservation projects more difficult to pencil out, but it would hit many historic preservation-minded businesses who have come to depend on this credit, either directly and indirectly.

Anderson House in Manti who received the tax credit.

What you can do to help:

Contact your own Utah House Representative as well as HB 262's sponsor, Rep. Kay Christofferson of Utah District 56 / Lehi and tell them how much you value the Utah residential historic preservation tax credit.

One pager of talking points on the Utah State Historic Tax Credit and its benefits.

Let your representatives know that this credit:

- Increases state tax revenues by spurring private investment (see table)

- Supports Utah's local economies

- Funnels federal dollars into local economies by partnering with the federal preservation tax credit

- Sustains naturally occurring affordable housing

- Revitalizes neighborhoods across the state

- Preserves Utah's rich history

This report includes a breakdown of the value of this residential credit to the State of Utah. It also includes images of buildings that have recently been or will be revitalized using this tax credit.

PLEASE SUPPORT UTAH'S HISTORIC PRESERVATION TAX CREDIT BY TAKING ACTION TODAY!!!

Borden Milk Plant in Logan now lofts thanks to the state tax credit!

Please explore the information below by clicking on the article title to read.

Please sign our Google Form to indicate your support for West High School.

Letter to the School Board and Arguments for Preservation

Preservation Utah Letter to the School Board and Arguments for Preservation (PDF)

School Board Presentation: Feasibility Study on West High School

West High School Feasibility Board Presentation (pages 16-24, PDF)

West High School History

West High School History, A Long Search for Home, by David Amott, 1.2023 (PDF)

Ogden High School Retrofit

Ogden High School: How A Utah Community Saved It's Beloved Art Deco Gem, by Saving Places, 2014 (article link)

Marble walls and Art Deco: This Utah school is straight out of ‘The Great Gatsby' ABC4, 2021 (article link)

South High School Retrofit

Old South High houses community college in style, SL Tribune, 1991 (PDF)

Classy Old South High Dresses up for College, SL Tribune, 1991 (PDF)

Seismic: In the 1990s, Salt Lake City School District sunk millions of taxpayer dollars into West High School's seismic retrofit.

Seismic: In the 1990s, Salt Lake City School District sunk millions of taxpayer dollars into West High School's seismic retrofit.

West High Retrofit Hits $19.7 Million, Deseret News, 1996 (article link)