Updated 2/17/2022 at 9 am

Thank you! The Utah State Historic Tax Credit remains safe. H.B. 262 didn't make it past its committee hearing. There was support online and within the committee itself for the tax credit. We will continue to keep our eyes on any threats to the bill and keep you informed.

A bill was launched in the Utah State House of Representatives (H.B. 262 - Lines 77 and 1167) which if passed would have:

-

- Reduced the Utah preservation residential tax credit from 20% of qualified expenses to 10% of qualified expenses – lines 1166-1167. If someone spends $10K on a project they would get a $1,000 state income tax credit instead of $2,000.

- Eliminated the credit for corporate income tax (line 77). This would make it harder for corporations to utilize the credit when rehabilitating historic spaces for residential use or to invest in these projects.

In aggregate, the inclusion of the preservation tax credit in this bill threatened the preservation movement in Utah. Not only would this bill, if passed, make residential historic preservation projects more difficult to pencil out, but it would hit many historic preservation-minded businesses who have come to depend on this credit, either directly and indirectly.

Anderson House in Manti who received the tax credit.

What you can do to help:

Contact your own Utah House Representative as well as HB 262's sponsor, Rep. Kay Christofferson of Utah District 56 / Lehi and tell them how much you value the Utah residential historic preservation tax credit.

One pager of talking points on the Utah State Historic Tax Credit and its benefits.

Let your representatives know that this credit:

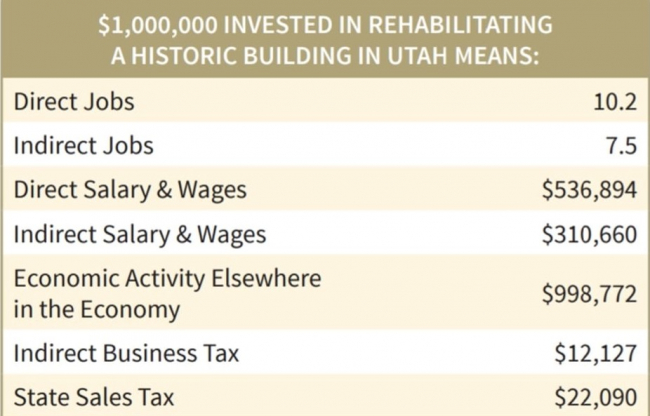

- Increases state tax revenues by spurring private investment (see table)

- Supports Utah's local economies

- Funnels federal dollars into local economies by partnering with the federal preservation tax credit

- Sustains naturally occurring affordable housing

- Revitalizes neighborhoods across the state

- Preserves Utah's rich history

This report includes a breakdown of the value of this residential credit to the State of Utah. It also includes images of buildings that have recently been or will be revitalized using this tax credit.

PLEASE SUPPORT UTAH'S HISTORIC PRESERVATION TAX CREDIT BY TAKING ACTION TODAY!!!

Borden Milk Plant in Logan now lofts thanks to the state tax credit!